In today’s financial services landscape, advisors and executives need more than just raw data—they need meaningful insights that bring together fragmented information into a single, clear view. That’s where Record Rollup Definitions in Salesforce Financial Services Cloud come in. This feature enables financial institutions to automatically aggregate values like assets, policies, liabilities, or opportunities from related records and display them at the group level—such as a Household, Trust, or Business Relationship.

Instead of manually piecing together numbers across multiple records, advisors can instantly view consolidated metrics like total assets under management or the number of policies in force. The flexibility of Record Rollup Definitions goes beyond out-of-the-box rollups; admins can configure custom rollups, apply filters, set join conditions, and choose aggregation methods like SUM, COUNT, MIN, MAX, or AVG. This functionality not only streamlines data management but also enhances advisor efficiency, client engagement, and executive decision-making, making it a cornerstone of delivering personalized and data-driven financial services.

Record Rollup Definitions

Record Rollup Definitions in Salesforce Financial Services Cloud allow you to automatically aggregate data (like total assets, number of accounts, or policies) from related records and roll it up to a parent record—most commonly, from individual clients to a group like a Household, Trust, or Business Relationship.

This feature helps financial professionals quickly view summarized metrics for entire groups, improving decision-making and client servicing.

Benefits

- Single View of Financial Relationships: Instantly see total assets, liabilities, or insurance coverage at the household or group level.

- Improved Advisor Efficiency: Advisors no longer have to manually calculate or search for aggregate values.

- Better Client Engagement: Enables personalized advice based on full household financial status, not just an individual’s.

- Customizable for Any Data Point: Roll up anything from financial accounts to custom object records (like insurance policies, opportunities, etc.).

Feature Highlights:

- Pre-Built Rollups Available: FSC includes standard rollups like Total AUM (Assets Under Management), Total Policies, and Total Liabilities.

- Supports Custom Rollups: You can define rollups for custom objects, custom fields, and apply filters to control what’s counted or summed.

- Supports Aggregation Functions: Includes SUM, COUNT, MIN, MAX, AVG.

- Real-Time Updates: Rollups update automatically when related records change (triggered via platform events behind the scenes).

- Accessible in Reports & Dashboards: Rollup fields can be used in all standard Salesforce reporting tools.

Fragmented data across multiple objects makes it tough for business executives to consolidate information and make informed decisions. Consolidating information from multiple objects can be complex, as these objects aren’t always directly linked.

Use Record Rollup Definitions to streamline the aggregation of records from various objects or groups. Additionally, use filters and join conditions in the record rollup definitions to effectively and efficiently aggregate records between two objects.

To show the record rollup results in a clear and organized format, use the ShowRecordRollupResults component on a rollup target object’s record details page. Business executives can make more informed and precise decisions by using this comprehensive overview of the combined data.

Implementation Instructions

Enable Group Record Rollups (if not already)

- Go to Setup > Guided Setup > Record Rollups complete step 1: Configure Your Org for Record Rollup Definitions (in the FSC Trail org the permission are already set up)

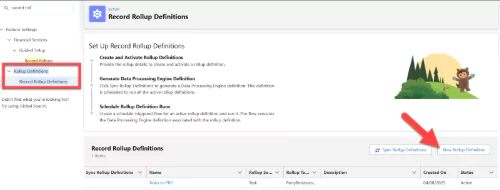

- Go to Rollup Definitions > Record Rollup Definitions Search for and open Group Record Rollup Settings and create a new Rollup Definition from here.

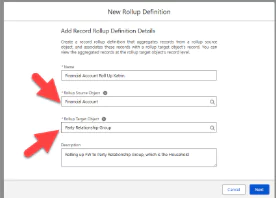

- Click New Rollup Definition “Financial Account Roll Up Test” and fill in the fields.

- Rollup Source Object = Financial Account

- Rollup Target Object = Party Relationship Group

- Click Next.

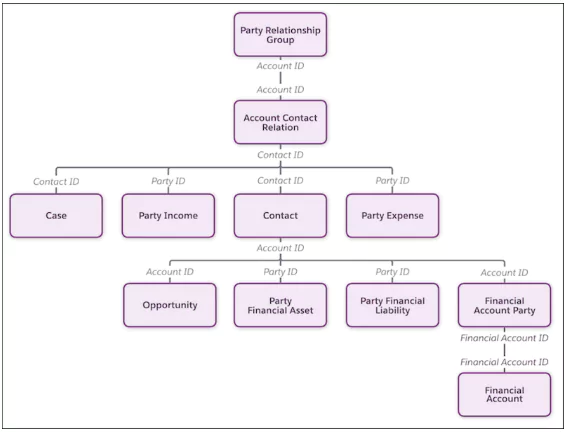

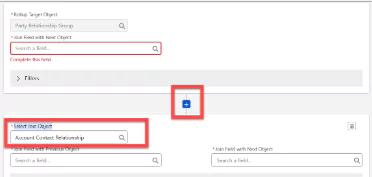

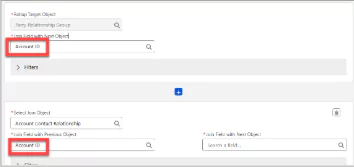

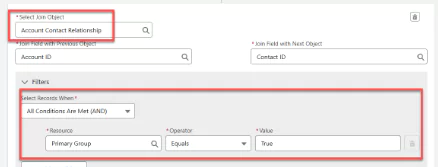

- Now the Admin needs to define the Join Conditions: Party Relationship Group is the Household and I need to get from there to the Member. I’m using the Account-Contact-Relationship to build this out

- Click the + sign and select Account Contact Relationship in field Select Join Object.

- Now join the Account ID from the Party Relationship Group with the Account ID from the from the Account-Contact-Relationship Account ID.

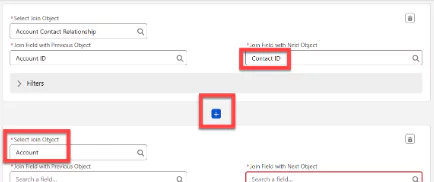

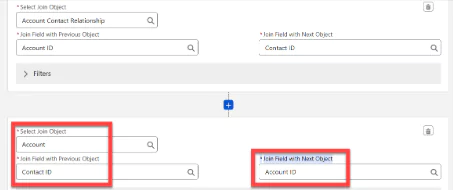

- Click the + sign again and select Account Object.

- In the field Select Join Object, and to get to the Household Member and we are going to select Contact ID in the Join Field with Next Object.

- In the section with Join Object Account we enter the Contact ID to the field Join Field with Previous Object and add Account ID to the field Join Field with Next Object.

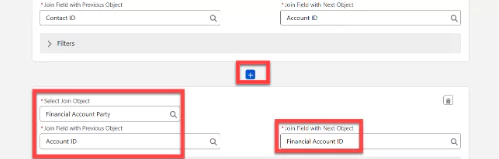

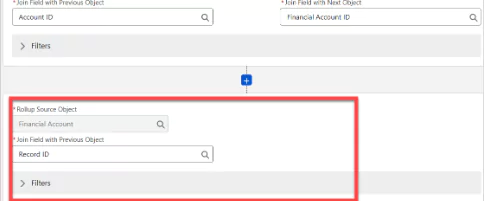

- We Click the + sign again to join this now with the Financial Account Party and select the join condition with the previous object, which is the Account ID.

- In the field Join Field with Next Object I select Financial Account ID.

- And now we have to join it with the Financial Account ID field.

- Further you can add filter conditions, for example Primary Group Equals True as well. (See Developer documentation)

- Save and Activate it.

- Go back to Record Rollup Definitions and Sync & Activate.

Test and Validate

- Go to a Group (e.g., a Household record)

- Ensure it has members and related records

- Confirm the rollup field is populated correctly

Use Cases

- Total Household Assets

- Number of Insurance Policies

- Total Opportunity Pipeline

- Average Account Balance

- Youngest/Oldest Household Member (using MIN/MAX)

Summary

Record Rollup Definitions in Financial Services Cloud provide a powerful way to consolidate and surface critical financial data at the household, business, or trust level. With support for both prebuilt and custom rollups, they eliminate the need for manual calculations while ensuring advisors and executives always have access to real-time, aggregated insights. By leveraging filters, join conditions, and aggregation functions, businesses can tailor rollups to meet their unique needs—whether tracking total household assets, the number of insurance policies, or average account balances. The result is a more comprehensive client view, faster advisor workflows, and better-informed decisions, all of which strengthen client relationships and organizational efficiency.