Managing client financial data effectively is at the heart of Financial Services Cloud, and Salesforce makes this process easier with features like Roll-Up Summaries and Account Ownership. Roll-Up Summaries in FSC provide a consolidated view of a client’s financial information by aggregating data from related records such as Tasks, Events, and Financial Accounts. This capability empowers advisors to quickly see a client’s full financial picture without manually reviewing each record. Unlike standard Salesforce roll-ups that work only with master-detail relationships, FSC introduces specialized objects—Rollup By Lookup Config and Rollup By Lookup Filter Criteria—to calculate roll-ups using lookup relationships, giving more flexibility to financial institutions. Combined with Account Ownership rules, these roll-ups determine not just what data is aggregated but also how it’s attributed to individuals, households, and groups. In this blog, we’ll explore how roll-ups work in FSC, how to test them in real scenarios, and how ownership settings can directly impact the accuracy of client financial summaries.

Roll-Up Summaries

In Financial Services Cloud, client data like Tasks, Events, and Financial Accounts, is aggregated or rolled up into the client’s financial summary. The summarized data makes it easy to see a client’s complete financial picture.

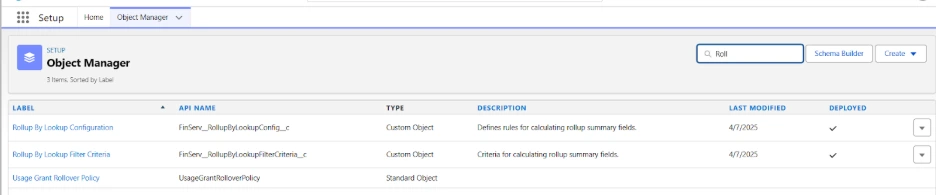

We are using the custom objects Rollup By Lookup Config and Rollup By Lookup Filter Criteria that come with Financial Services Cloud. These objects enable calculation of rollup summaries based on lookup field relationships between objects, rather than master-detail relationships. You can check them out in the Object Manager.

Financial Services Cloud provides several out-of-the-box rollup summaries at the person and group levels, including the following.

- Total Financial Accounts

- Total Bank Accounts

- Total Investment Accounts

- Total Insurance Policies

- Assets Under Management

- Wallet Share

- Total Assets

- Total Liabilities

You can only set rollups to the primary group. If the Primary Group field is not enabled, the option to roll up is restricted. We don’t recommend or provide support for creating or customizing Financial Services Cloud Rollup By Lookup (RBL) rules.

Test Roll-Up Summaries

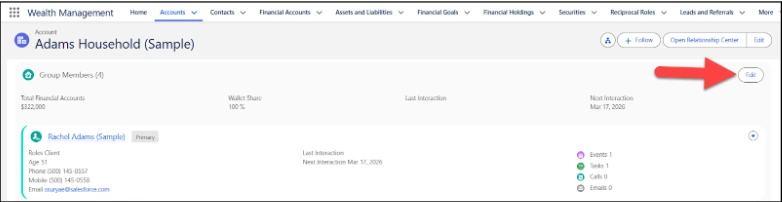

- Navigate to the Wealth Management App via the App Launcher

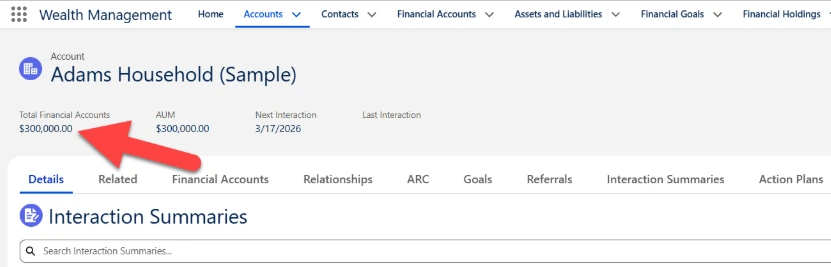

- Click on the Accounts Tab and select the Adams Household (Sample) Account

- Take a note of the total Total Financial Accounts value in the Adam’s Household (in this example, $300,000.00)

Now let's give Scott Adams some additional money…

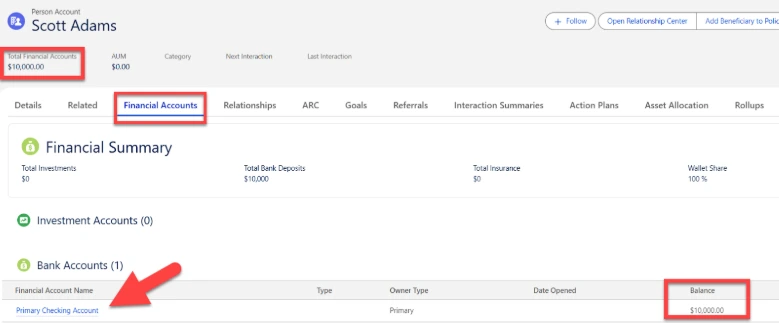

- Click on the Account Tab, open the Scott Adams Account Record.

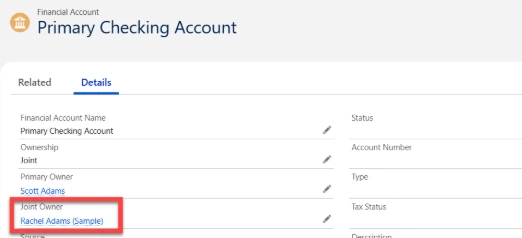

- Click the Financial Account Tab and open the Primary Checking Account.

- You can see that Rachel Adams is a Joint Owner of Scott’s Primary Checking Account.

- Go into Scott’s Primary Checking Account and change the balance to $22,000.

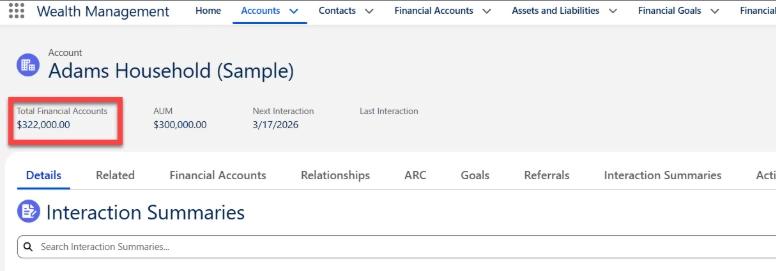

- Now let’s navigate back to the Adams Household Account via the Account Tab and check the Total Financial Accounts balance. The Account balance for the Adams Household has now changed to $322,000.00.

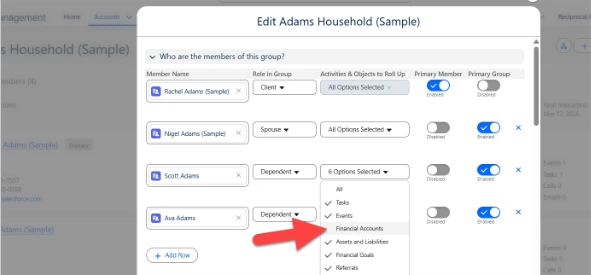

Defining What Gets Rolled Up to the Primary Group

- Click the Relationships tab in Adams Household (Sample) Account and scroll down to the Group Members section. To make changes to the Roll-ups you can change the selection of Activities & Objects to Roll Up directly from the Group Member Card > click Edit.

- Change Scott Adams’ Roll Ups and remove Financial Accounts and click Save.

- You will realize that the Total Financial Accounts balance on the Adams Household has changed from $322,000.00. to $300,000.00. because you removed Financial Accounts in Scott Adams’ Roll Ups.

Account Ownership & Roll-Ups

Account Ownership also has an impact on Roll-Ups. Let’s test this with Rachel & Scott.

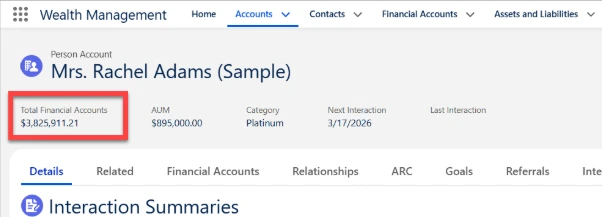

- Check the balance of Total Financial Accounts in Rachel Adams Person Account ($3,825,911.21)

- Now let’s go to Scott’s Primary Checking Account and review the owners. You can see that Rachel Adams is a Joint Owner.

- Remove Rachel Adams as a Joint Owner and go back and check the balance of Total Financial Accounts in Rachel Adams Person Account. It went from $6,803,911.21 to $3,803,911.21.

Summary

Financial Services Cloud simplifies complex financial data management through its Roll-Up Summaries and Account Ownership features. Roll-ups allow advisors to view total financial accounts, liabilities, and assets under management at the group or individual level, while ownership rules determine how these numbers are distributed across accounts. By using out-of-the-box roll-up configurations, financial institutions can reduce manual effort, ensure data consistency, and maintain a clear, client-centric financial overview. Together, these tools provide the transparency and accuracy needed to build trust with clients and make informed financial decisions.