In Salesforce Financial Services Cloud (FSC), every client’s financial world extends beyond individual accounts—it includes families, households, business entities, and professional connections. To accurately represent these complex networks, FSC provides the ability to customize Group Types and Roles, ensuring that organizations can model real-world structures with precision.

By defining group types such as Households, Trusts, or Business Relationships and assigning meaningful roles like Spouse, Beneficiary, or Trustee, advisors gain a clearer view of how clients and their related parties are connected. This not only helps in providing personalized advice but also supports compliance, collaboration, and reporting across the client lifecycle. Customization empowers firms to go beyond the out-of-the-box setup, tailoring role definitions, roll-ups, and relationship maps to meet unique business needs. In this blog, we’ll walk through how to configure group membership, set up permissions, define group roles, and enhance record pages with relationship components so that advisors can unlock the full value of Group Membership in FSC.

Customize Group Types and Roles

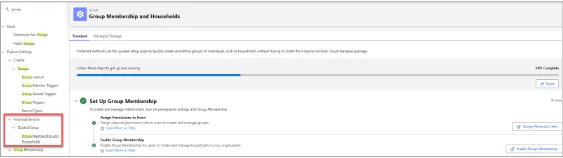

- Go through to Setup > Guided Setup > Group memberships & Households

-

Assign Permissions to Users Note: (no need to configure this in the FSC Trail Org) Admins usually create a Group Membership Permission Set for users that need access to Group Membership. Users will also need Financial Services Cloud Extension. Other required permissions required to use the guided flows for merging and splitting party relationship groups can be found HERE.

-

Enable Group Membership: Settings > Quick Find > Group Membership Settings Note: This is already enabled in the FSC Trial org. This setting gives access to the data model and 2 ARC templates that visualize Household & Groups.

-

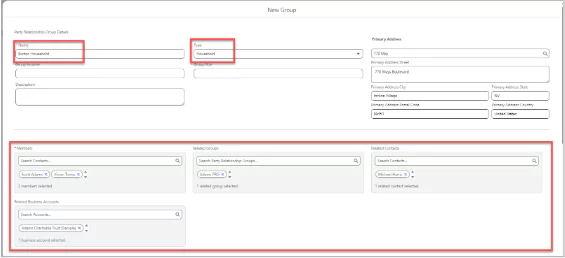

Go to App Launcher > Party Relationship Groups and click New Group.

-

Add Name, Type “Household”, Members, Related Groups, Related Contacts, Related Business Accounts.

- Click Next.

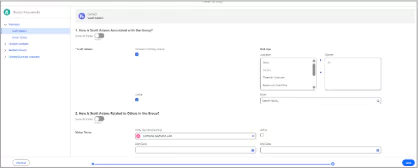

- Now you can define Group Membership Roles, Roll-Ups and Relationships within the Household.

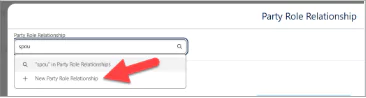

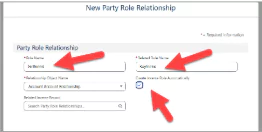

- To create a new New Party Role Relationship search in the Party Role Relationship field by typing Spouse and hitting Enter. This will open up a search window.

- Next click the + New Party Role Relationship.

- Fill out the fields and click Save.

- If you receive an ERROR message - we are working on fixing the issue.

Wrap-Up: Key Tips

Automate group creation using flows for onboarding processes. Use Reports & Dashboards to track group activity and roles.

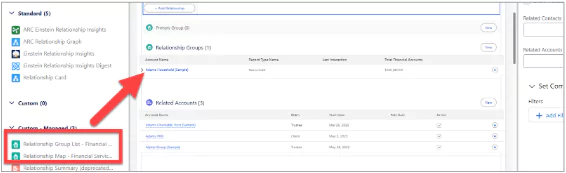

Once you’ve enabled Relationship Groups in Financial Services Cloud, you’ll want to make them visible and usable for end users - especially on the Person Account (Client) and Group (Household/Trust) record pages.

Here’s a step-by-step guide to configure the page layouts and related lists:

Add Relationship Groups to Lightning Page Layouts

Use the Lightning App Builder to enhance usability.

- Navigate to the Wealth Management App > Accounts > Rachel Adams > click > Edit Page.

- Click the Relationships Tab and drag and drop Relationship Map component (visualizes member relationships) into the canvas. (This is already done in the FSC Trial Org)

- Next drag & drop Related Groups List component onto the canvas (also already done in FSC Trial Org)

- Click Save, go back to Rachel Adams’ Person Account and open the Relationships Tab.

Summary

Customizing Group Types and Roles in Financial Services Cloud allows financial institutions to model households and client groups in ways that reflect real-life relationships. With features like Party Relationship Groups, Role Definitions, and Relationship Maps, advisors can capture client associations more accurately, visualize them on Lightning pages, and use roll-ups for actionable insights. By assigning the right permissions, enabling group membership, and configuring record layouts, firms can ensure advisors have a holistic, role-based view of clients and their extended networks. This flexibility strengthens client engagement, supports regulatory compliance, and drives more informed financial decision-making.